Acapulco — Online Supplies for Bars, Cafés & Restaurants

We built the "smart restock" marketplace, which attracted investors, and a blunt model that made us pause. We offer cloud-level polish and ground, truth honesty. In under six months, we saved five or six figures.

Tuesday, 06:00 in the morning. A café owner texted a supplier, again: “We’ll run out of milk by noon, any chance?” The answer, like most days, depended on trucks, guesses, and goodwill.

Our goal was to give bars, cafés, and restaurants a calmer morning, so we designed a marketplace that made restocking predictable, compliant, and cost-effective.

But alter, here’s the spoiler alert: this is a failure case-study.

Role

Co‑founder & Product/UX Lead

Client / Market

Myself

Timeline

2018–2019

Who might find this case interesting?

Product leaders in ops‑heavy businesses who need digital experiences tied tightly to real‑world fulfillment, inventory, or compliance.

Teams that want to de‑risk before code—validating demand, unit economics, and service blueprints with prototypes and models.

Founders and executives who prefer decisive truth—when to accelerate, when to pivot, and when an honest pause protects capital.

Jump to Project's Media and Screenshots ->

What We Were Really Solving

Not a catalog. A rhythm. Venues buy the same staples on repeat; suppliers juggle cold chain, substitutions, and narrow margins. People were spending more time negotiating failure than operating a business. If we could turn recurring chaos into reliable cadence—forecasted demand, consolidated routes, traceability by default—we’d create value on both sides.

From Hypothesis to Ground Truth

I co‑founded Acapulco with a simple thesis: focus the MVP on recurring essentials and scheduled delivery windows, not an “everything store.” We spent mornings observing stock checks and order calls, afternoons with wholesalers and drivers. Patterns emerged—drop sizes too small, routes too long, compliance paperwork always late. The pain was real; the economics were… fragile.

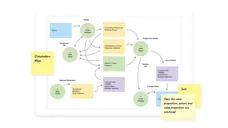

Designing the Service, Not Just the Screens

We wrote the service as a story: venue opens app, confirms a smart restock, selects a real delivery window; supplier picks by lot and expiry; driver scans on drop; invoices reconcile automatically. Each step surfaced the realities people normally hide: substitutions, traceability, cut‑offs, and route density. I mapped this into a service blueprint so ops, product, and finance could argue with the same picture.

The Product We Shipped in Prototype

The experience was intentionally honest. Delivery slots reflected the actual fleet, not wishful thinking. Recurring staples auto‑suggested, but required explicit confirmation—great UX doesn’t auto‑buy milk for you after a bank holiday. Compliance lived in the cart: we captured batch/lot data at selection, and showed it again in the order and the receipt. Prices negotiated by venue appeared transparently at checkout.

The Work Behind the Curtain

Alongside the clickable prototypes and a modular design system, I built the financial/ops model in spreadsheets: margin sensitivity by category, distance, failure rate, and drop size. We stress‑tested what “good” looked like: minimum route density, anchor venues per zone, substitution rules that didn’t destroy margins, and the supplier SLAs required to make promises we could keep.

The Investor Meetings

The story resonated. Demos clicked. The model didn’t over‑promise. Most funds and angels were blunt: “Come back when the MVP is coded and live—then we’ll talk.” And even then, several balked. Alliances with suppliers were politically hard, and the stock burden to guarantee service levels made the business far less attractive. Without dense routes and pre‑signed anchors, every extra kilometer ate the margin—and the need to hold inventory scared many away.

The Decision (and Why It Was a Good One)

We paused the full build. That sounds like failure; it wasn’t. We converted ambiguity into a decision you can act on. The research, blueprint, prototypes, and unit‑economics model spared a seven‑figure misallocation and gave us a clear path to a viable launch: secure anchor venues, negotiate SLAs with two dependable suppliers per zone, prove route density with a pilot—then scale.

What Changed Because of This Work

Café owners still text suppliers at 6 a.m., but now there’s a blueprint other teams have used to do it better. I reused the viability checklist—recurring demand, route density, compliance at the point of sale—in later e‑commerce projects. More importantly, the project recalibrated my definition of “great UX”: it’s not only smooth flows; it’s the integrity to expose constraints so leaders can make the right call.

What I Learned About SaaS (and Why Investors Prefer It)

This project made the investor lens click for me. SaaS is asset‑light, doesn’t carry perishable stock, and scales without trucks. Recurring revenue is predictable; gross margins are higher; working capital needs are lower. You can prove traction with code and a handful of customers, not a fleet. Angels and VCs prefer that capital efficiency: faster payback, clearer LTV/CAC, cleaner cohorts, and defensible compounding through roadmaps—not warehouses. In short, SaaS lets founders spend money on learning and product, not on diesel and spoilage, which is exactly what early‑stage capital is designed to fund.

What I’d Do Differently Next Time

From day one, I would design the value proposition for three audiences: customers, investors, and the team. Product/market fit, capital fit, and team fit rise (or fall) together.

For customers, narrow the focus to a painful, high-frequency task and prove the business case in weeks, not months.

For investors, first frame an asset-light path (SaaS/service layer) with a staged proof plan, LOIs, paid pilots, repeatability, and a funding map where each tranche removes a specific risk (unit economics, distribution, and operations).

For the team, make it appealing to builders with a clear mission, fast learning loops, real ownership, and a precise technical scope that shows how they will ship within weeks.

Practically, I would secure anchor LOIs and supplier MOUs before writing any code. I would also instrument a metrics spine that rolls product signals up to unit economics (gross margin per order, utilization, and payback).

I would ship an investor-ready pilot with live dashboards, publish a builder onboarding pack (architecture, design system, and delivery cadence), and gate rollout by zones to protect margins and morale.

I would prioritize SaaS-first value tools that deliver immediate ROI without inventory, using services only where they create proprietary data or defensibility. The result is a story that moves three needles at once: customer outcomes, capital efficiency, and hiring velocity.